corporate tax increase uk

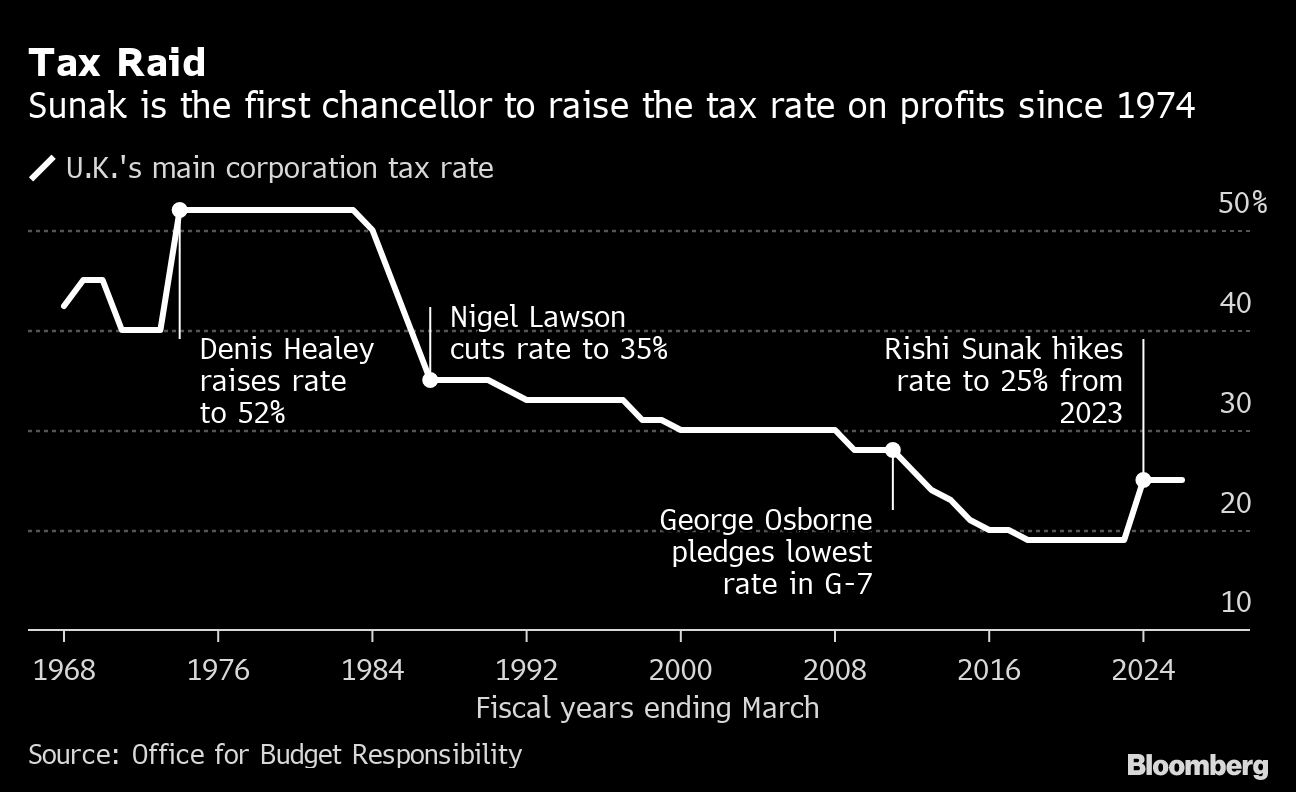

In April 2023 the rate of corporation tax will increase to 25 a 6 increase from the current 19 while at the same time creating a small profits rate for businesses with less than 50000 profit who will continue to pay corporation tax at the current 19 rate. From April 2023 the CT rate will rise from 19 to 25 marking a near 50-year downward trend in the main rate of Corporation Tax.

This new rate will be paid in full by companies whose profits exceed 250000.

. The hike in corporation tax is expected to raise an additional 22bn in revenues a year with the tax take. What Is Happening To The Uk Corporation Tax Rate In 2023. The announced increase was also at the higher end of expectations and sparked.

Smaller limited companies will not be included in this increase. For UK companies one of the biggest taxes to be planning ahead for is the increase to corporation tax. Where the taxable profits can be attributed to the exploitation of patents a lower effective rate of tax applies.

Raising the corporate rate to 25 percent would raise about 5221 billion between 2022 and 2031 on a conventional basis see Table 5. Reduced economic output would mean that revenue only rises by 3916 billion dynamically. Over the past 20 years the corporate tax rate has fallen from 30 per cent.

By RJP LLP on 9 November 2021. Nations as an excuse to cut domestic corporate tax rates risking a new race to the bottom More on this story. The current 19 rate will apply to companies with profits of 50000 or below and.

In his Budget on Wednesday Sunak announced that corporation tax would increase from 19 per cent to 25 per cent in 2023 making him the first chancellor to raise. The increase in corporation tax from 19 to 25 in 2023 would mark the first attack on company profits since the Labour chancellor Denis Healey raised corporation tax in 1974 in the wake of the. The main rate of corporation tax will increase from 19 to 25 as of April 2023 and companies that earn less than GBP 50000 per year will see their small profits rate increase from 19 to 19.

Corporation tax made up 6 of total tax receipts in 201920 and this increase will bring in an extra 12bn in revenue in its first year to which the rate applies. An increase in corporation tax from 19 to 25 from April 2023 is considered to be the most attractive option to begin the process of repaying the deficit. The normal rate of corporation tax is 19 for the financial year beginning 1 April 2021 and will be maintained at this rate for the financial year beginning 1 April 2022.

The new rate will be effective from 1 April 2023. From 1 January 2021 cross border mergers involving companies incorporated in the UK will no longer be possible. From 1 April 2023 an increase from 19 to 25 in the main rate of corporation tax and the introduction of a 19 small profits rate of corporation tax for companies whose profits do not exceed GBP 50000.

Ireland to increase corporation tax rate to 15. On 3 March 2021 the Chancellor Rishi Sunak made an announcement regarding corporate taxation in his Budget statement. In order to support the recovery the increase will not take effect until 2023.

Currently all companies regardless of the size of their profits suffer corporation tax at the rate of 19. If your business operates with profits of 50000 or less then you will instead continue to pay the current rate of 19 on a small. Almost 140 countries have taken a decisive step towards forcing the worlds biggest companies to pay a fair share of tax with plans for a global minimum corporate tax rate of 15 to be imposed.

Among other changes Finance Act 2021 increases the UK corporation tax rate from 19 to 25 effective 1 April 2023 for companies with profits in excess of GBP 250000. The 2021 Budget report estimated the new rates of corporation tax would raise 119 billion in 202324 rising to 172 billion in 202526. Significantly a new system of tapered relief will be introduced at the same time to link the rate of tax suffered to the amount of annual profits generated.

The changes to corporation tax will be introduced in April 2023. Where a company is subject to double taxation it may be able to seek resolution through mutual agreement procedure MAP. Changes in the UK corporation tax rates and major tax amendments included in Finance Act 2021 will have a direct impact on the recognition of current and deferred tax in company accounts.

Prior to this the two reforms to capital allowances were forecast to cost 123 billion in 202122 rising to 127 billion the following year. Tax Foundation General Equilibrium Model January 2021. There should be no retrospective taxation of past transactions.

Legislation will be introduced in Finance Bill 2021 to set the charge to Corporation Tax and set the main rate of Corporation Tax for all non-ring fence profits to 19 for Financial Year 2022 and. Businesses with profits of 50000 or less around 70 of actively trading companies will continue to be taxed at. The rate is 10.

The rate of tax for companies that earn over 250000 will rise to 25 from 19 starting in April 2023.

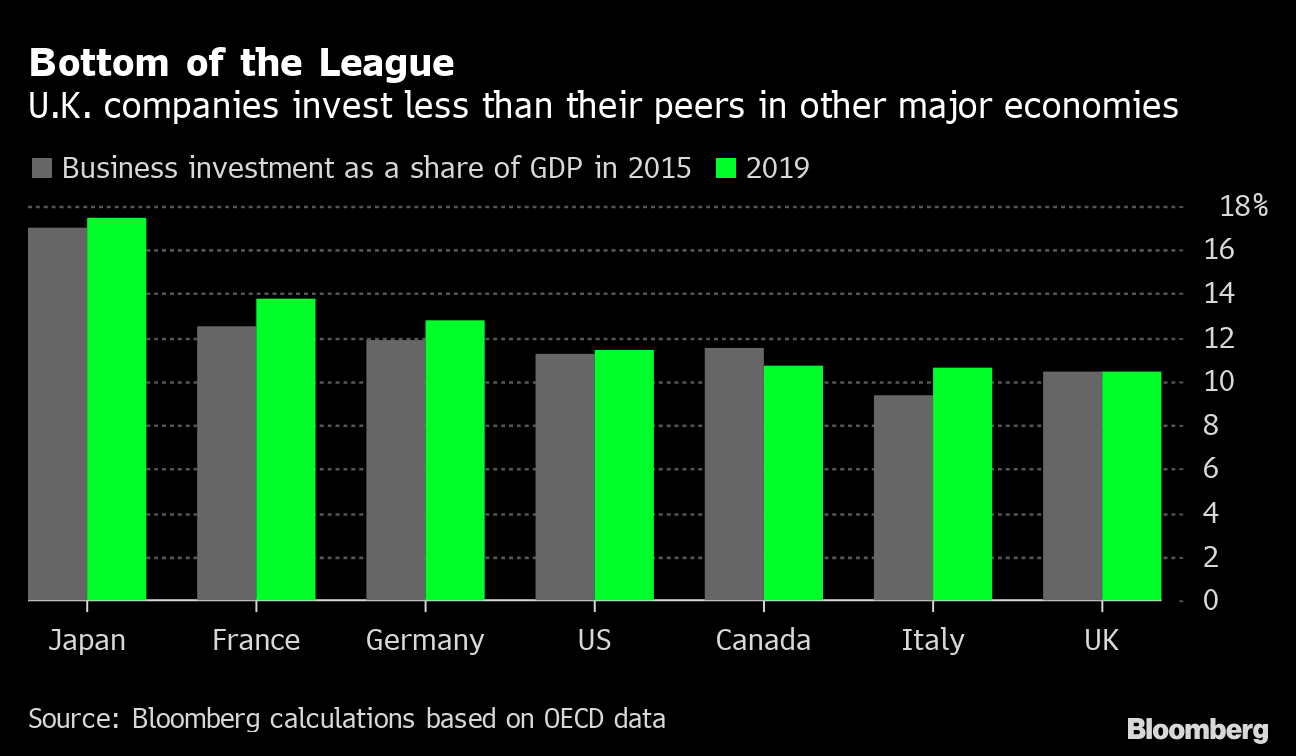

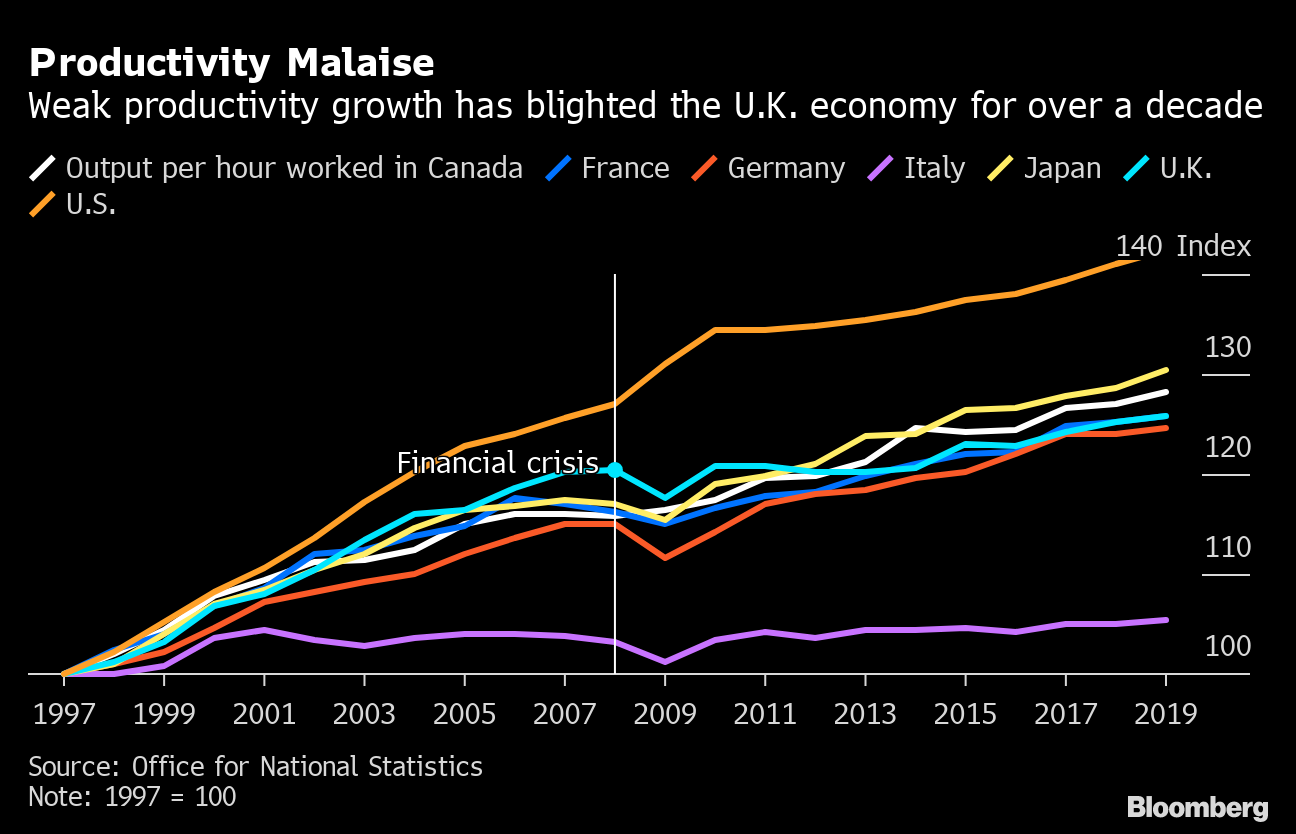

Sunak S Tax Cut Agenda Highlights A Weakness In The Uk Economy Bloomberg

The Simple Reason Why Donald Trump Is Great For Corporate America Show Me The Money Stock Market How To Plan

5 Businesses Running Rings Round Hmrc Tax Research Uk Infographic Business Corporate

Tax Rates Charts And Graphs Chart Graphing

Netflix Posted Biggest Ever Profit In 2018 And Paid 0 In Taxes Business Tax Deductions Tax Services Business Tax

Uk Taxation On Shares Example Forex Trading Forex Trading Brokers Forex Trading Training

Sunak S Tax Cut Agenda Highlights A Weakness In The Uk Economy Bloomberg

United Kingdom Corporation Tax Wikipedia In 2021 Financial Instrument Corporate United Kingdom

Importance Of Cost Accounting In The Medical Practice Http Www Harleystreetaccountants Co Uk Importance O Cost Accounting Company Structure Medical Practice

Best Payroll And Tax Services In Netherlands Payroll Financial Tax Services

Sunak S Tax Cut Agenda Highlights A Weakness In The Uk Economy Bloomberg

Progressive Tax Explained Raisin Uk

Corporate Tax Reform House Of Commons Library

How To Fund Basic Income In The Uk Part 3 Carbon Tax And Dividend Land Value Tax Dividend Income

Richard Burgon Mp On Twitter Richard Investing Twitter

Pin By Eris Discordia On Economics Economics Chart Line Chart

Top Money Paid By Clickbank And Clicksure Go To This Website Http Im 6p3qdhcw Yourreputablereviews Com Charts And Graphs Tax Return Graphing